The Dow Jones reaching 40,000! What’s next?

#188 An update on the US Indices: DJIA, S&P500 and Nasdaq.

Introduction

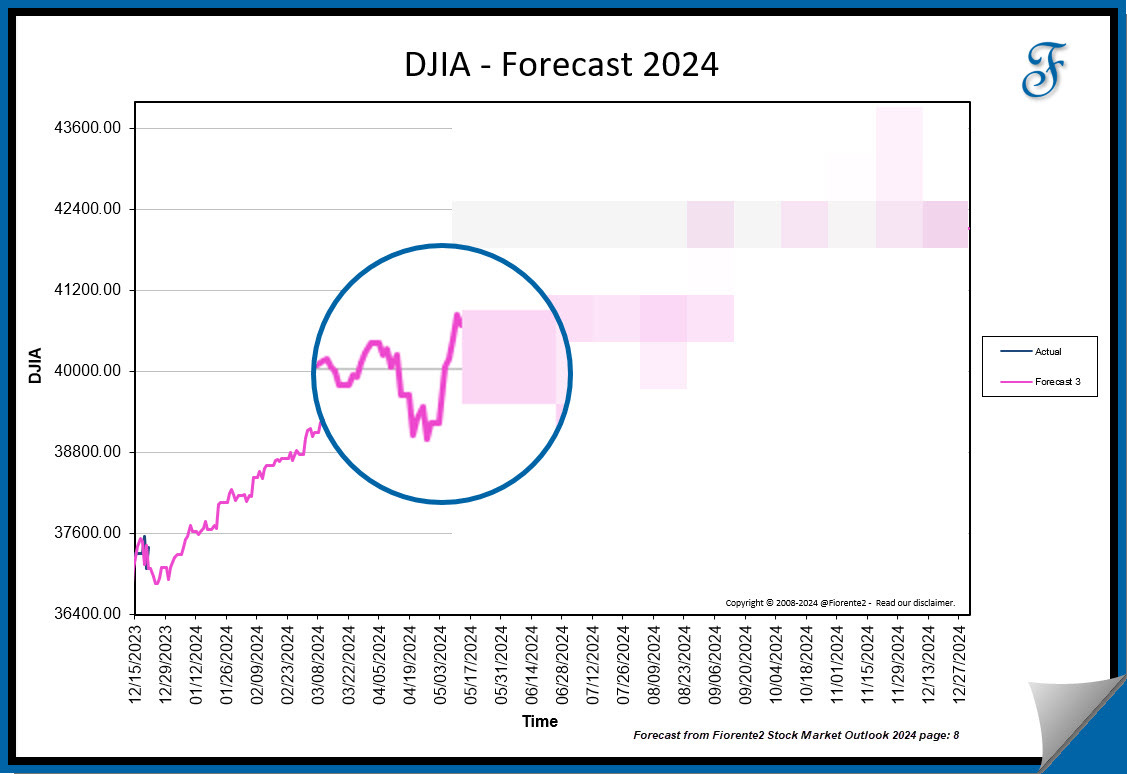

This week, the Dow Jones reached its target price of 40,000, a milestone that was accurately forecasted in my Annual Publication based on the 60-year cycle. Despite being a bit later than expected, this achievement underscores the usefulness of my forecasting methodology.

Buyers of the Stock Market Outlook 2024 may recognize the chart below which shows a partially enlarged snapshot from this year's annual forecast, as featured on page 8.

Can you imagine the Dow Jones soaring to 45,000-49,000 by late 2025 - early 2026?

The higher we get, the faster it goes. Historical and current trends suggest that this isn't just a dream. Technological innovation, sustained economic growth, favorable corporate earnings, ongoing investor confidence, and the potential for infrastructure investment may make it happen. The Federal Reserve's commitment to maintaining accommodative monetary policy and potential government stimulus measures could further bolster the market.

Therefore, there is a compelling argument to be made for the bull market's longevity and the Dow's potential to reach 45,000-49,000 by late 2025 - early 2026. Naturally, there will be pumps and dumps, ups and downs along the way.

Forecasting many years ahead can be challenging, as past trends may not necessarily repeat similarly in the future. Even long-term cycles can contract, extend, and invert.

In March 2009, I forecasted that the DJIA would reach 55,000 by 2026. However, the current forecast, ranging from 45,000 to 49,000, indicates that past trends may not necessarily repeat in the future with the same magnitude. As we approach the target date, forecasts are likely to become more accurate.

The premium subscribers can read on from here.