The days after US Thanksgiving - Nov 24, 2023

#158 - A Gann Master Cycle forecast following the DJIA, SPX, Nasdaq Composite & update on Walmart (WMT) and Visa (V)

Introduction

Last week I mentioned that financial market cycles tend to repeat themselves and sometimes in a mirrored fashion. As W.D. Gann mentioned in his Stock Market Course, "The future is just a repetition of the past. The same formation at tops or bottoms or intermediate points at different times indicates the trend of the market.".”

Will the normal seasonal trend I posted in last week’s edition continue to the year’s end, or will the inverted 60-year Gann Master Cycle continue at the end of this month in the DJIA and the SPX?

Perhaps the mood of investors may depend on the US retail shopping that traditionally starts after the US Thanksgiving. Around Thanksgiving 60-years ago there was a dip in the indices, perhaps an anomaly due to the sudden death of J.F. Kennedy. This year, we experienced a high, perhaps due to the changed polarity. We will have to see how this unfolds.

It is possible that the trend may continue, as the Mass Pressure posted last week indicates there is more upside potential. However the retailers are not that sure due to the economic pressure caused by high inflation.

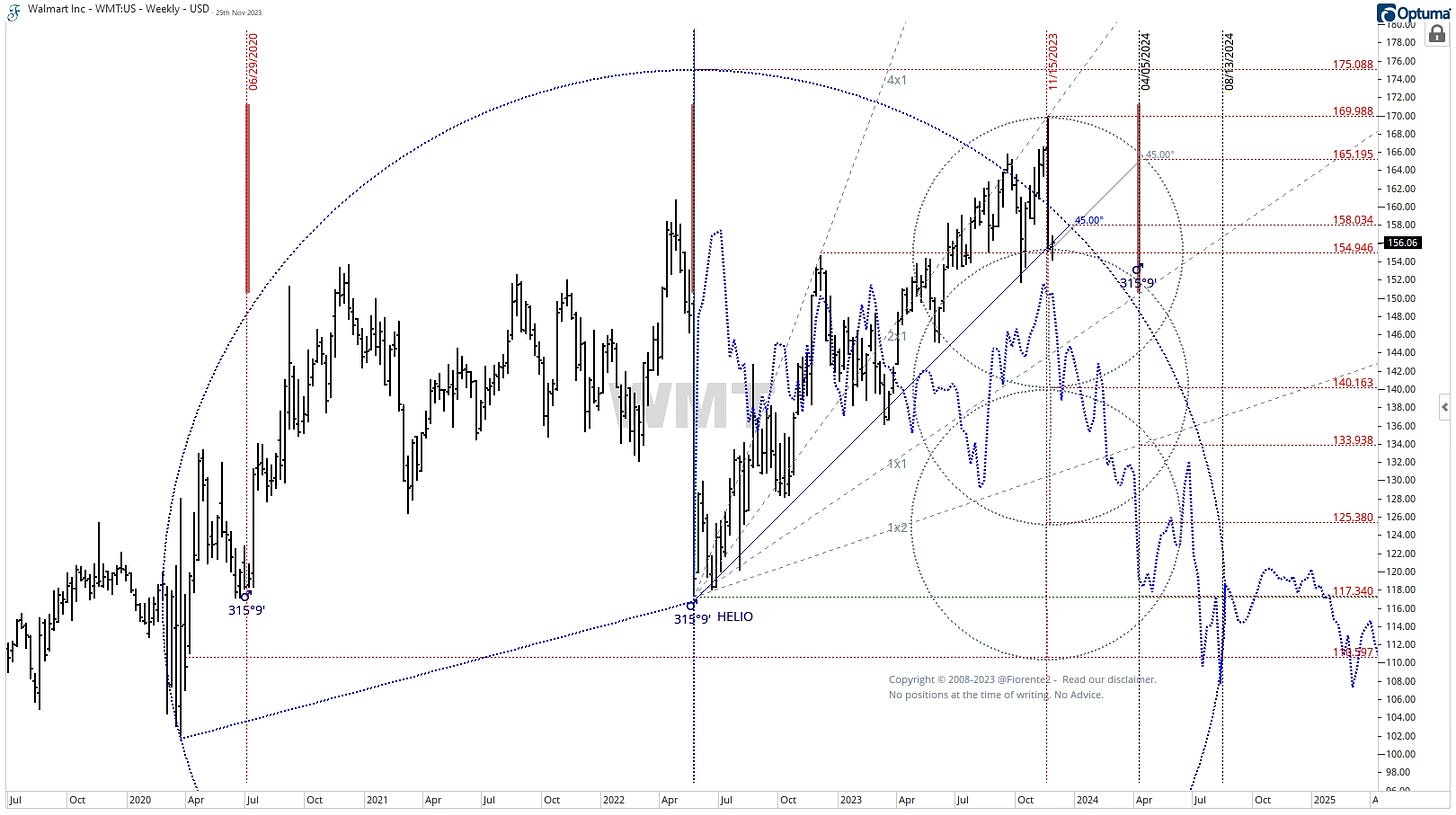

Retailers like Walmart (WMT) and Target (TGT) see shoppers cutting back on even groceries. Walmart’s expectations for the full-year revenue are below analyst’s expectations. You can see in the WMT weekly chart that a mirror image foldback is unfolding.

I do not like last week’s decline. This is often a sign that a trend may reverse. WMT bounced off the 1x2 Gann line. I drew a circle (which is a cycle in itself) around this weekly bar, and it may take a while before this cycle ends. As you also can see on this chart, the foldback(dotted blue line) seems to synchronize with the nice planetary symmetry of Mars at 315 degrees Helio. It is never guaranteed that a foldback will continue, but certainly, WMT is at an inflection point in time.

Perhaps if shopping next week will not disappoint this scenario will invalidate, and that may be a good first signal the Gann Master Cycle has reverted back to its normal course. I see similar fold-back scenarios on stocks like Visa (V), Mastercard (MA), and American Express (AXP).

For the premium subscribers, I have included a short analysis of Visa (V).

Get ready for Fiorente2 Stock Market Outlook 2024, a digital publication that provides a comprehensive analysis of World Indices, Commodities, Gold, Silver, Oil, Wheat, Treasury Notes, and Crypto Currencies. The publication will feature fully back-tested Mass Pressure Index charts for each equity for the full year ahead. Stay tuned for more announcements early next week! Last year’s owners and premium subscribers on Substack will be sent a discount code, as always.

In this week's edition of Fiorente2’s Newsletter, I have updated the Gann Master Cycle charts for the US Indices, and I will briefly discuss an update on Visa (V).

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.