Gann Master Cycle update - Sept 22 2023

A Gann Master Cycle forecast following the DJIA, SPX, Nasdaq Composite & Nasdaq 100 #148

Introduction

This is the 148th edition already of the Fiorente2 Newsletter, launched in January 2022.

In my last post, I discussed foldback patterns that may forecast where a stock or indices are heading. However, it's important to note that these patterns may not always work, so it's best not to rely on them solely. Another way to gauge the market's direction is by using cycles, timing lines and patterns

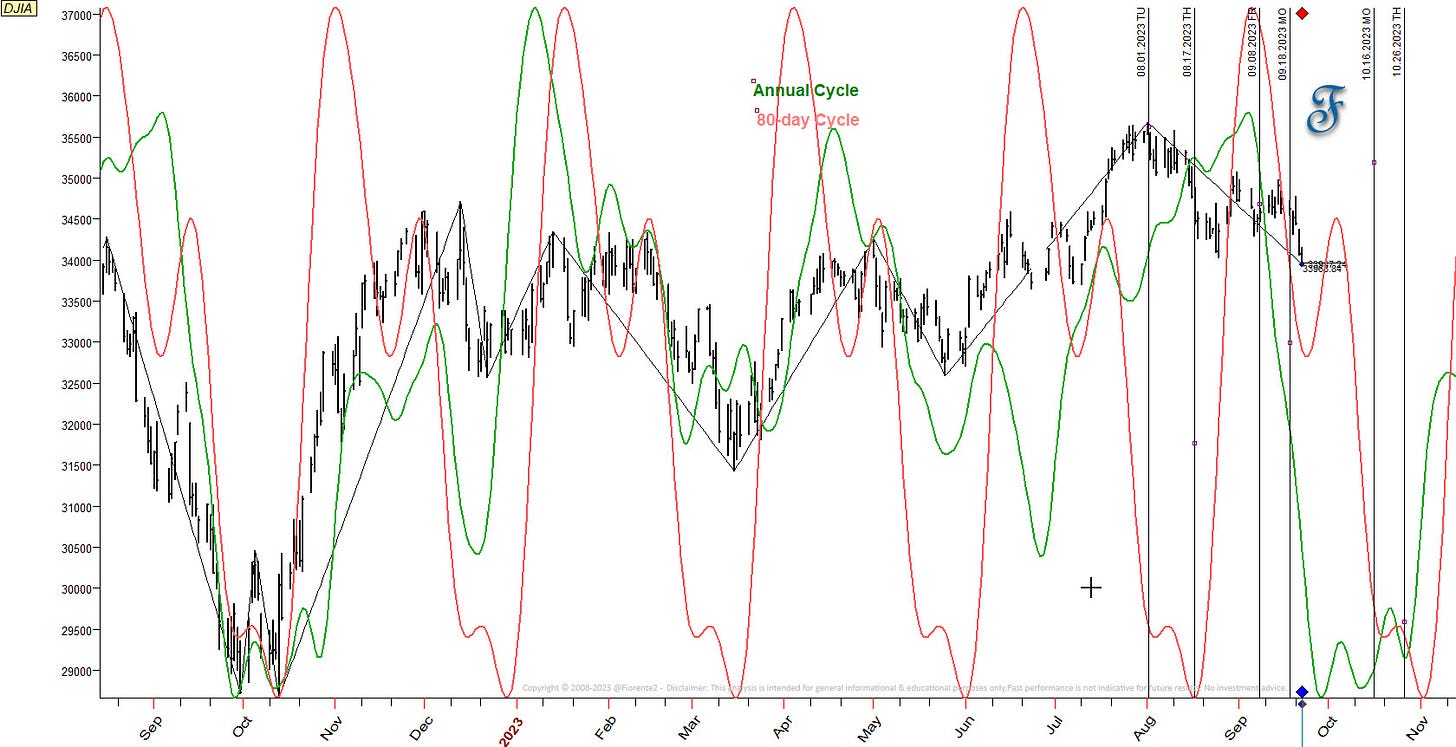

The DJIA chart below shows the annual cycle pattern, indicating that we are entering a season where the markets often make a low. The 80-day cycle also suggests a similar pattern, but the markets may first experience a short rebound after last week's downturn. Remember, Time is more important than Price, so the amplitude is not implied in this chart.

In this update on the US Indices, I will show you where we are on the Gann Master Cycles and where a possible cycle low in the US Indices may be expected. Timing lines and patterns may help to find where to find where price and time are in balance for a cycle low to occur.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.