Gann Master Cycle Update - May 19th 2023

A Possible Change in Trend on the Horizon for the Major US Indices: DJIA, SPX, and COMPX.

Introduction

Last week, I delved into the complex economic climate we're currently navigating, where escalating inflation and rising interest rates are putting banks in a precarious position. These shifts might be aligning with the Jupiter-Pluto transit, which has historical ties to financial crises. Could we be on the brink of a repeat of the May 1792 credit crisis and bank run in 2023?

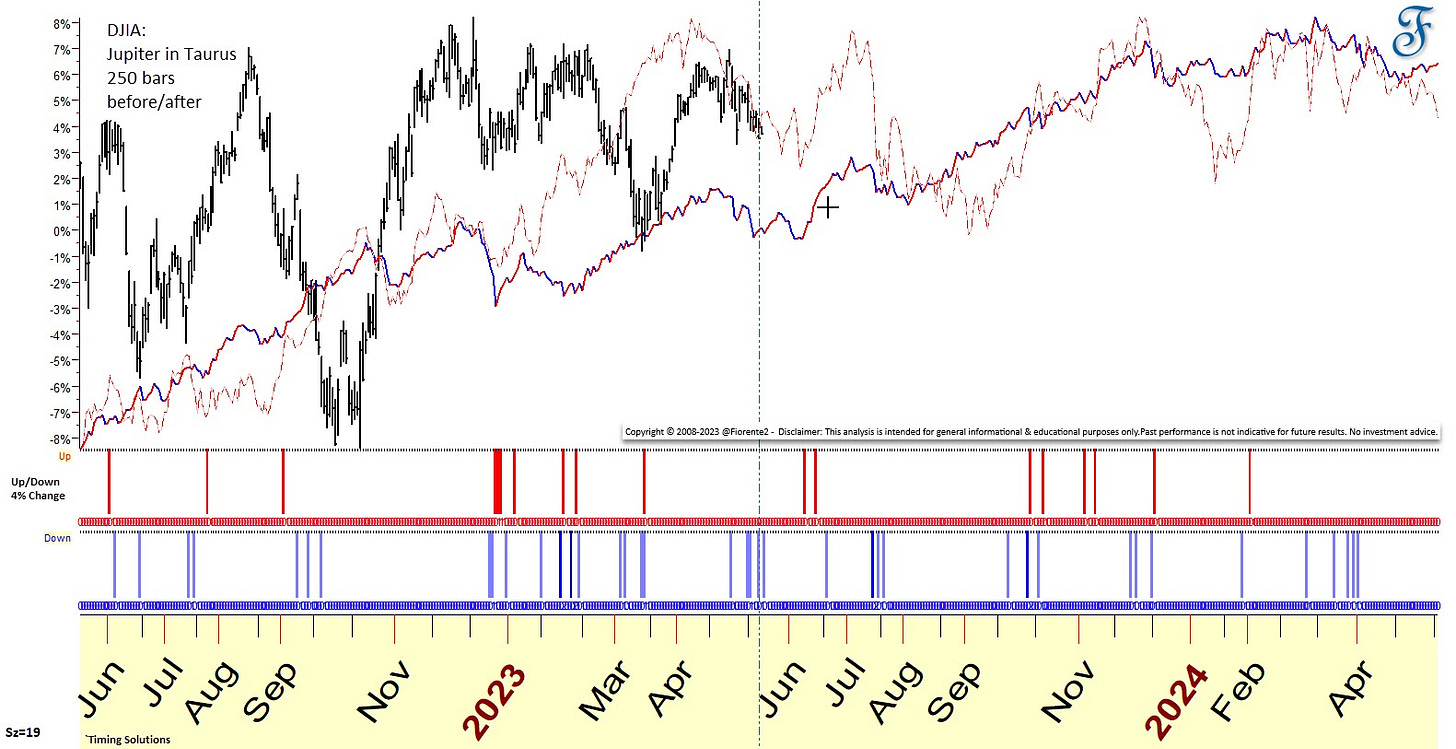

Raymond Merriman's recent insights have added another layer to this discussion. He pointed out in a tweet that the transit of Jupiter through Taurus, which just began last week, has historically been bearish for the Stock Market 75% of the time. Intrigued by this, I decided to run my own analysis using Timing Solutions software. The results? They echoed Merriman's conclusion.

The analysis shows a composite of all Jupiter in Taurus transits since the creation of the DJIA. You can clearly see the majority of all of the 4% up/down swings (red=bullish and blue=bearish) is bearish. Initially the first leg of the swing, after Jupiter ingresses Taurus is positive, but hereafter the risk is to the downside. There can be significant swings up or down.

In this week's update, I'll go deeper into these findings, following the Gann Master Cycles, and what they could mean for the DJIA, SPX, and COMPX. As always, it's important to remember that while we can prepare for potential shifts, the market's actual movements can still surprise us. Let's dive in."

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.