Gann Master Cycle - Oct 28 2022

$DJIA, $SPX and $COMPX following the Gann Master Cycles

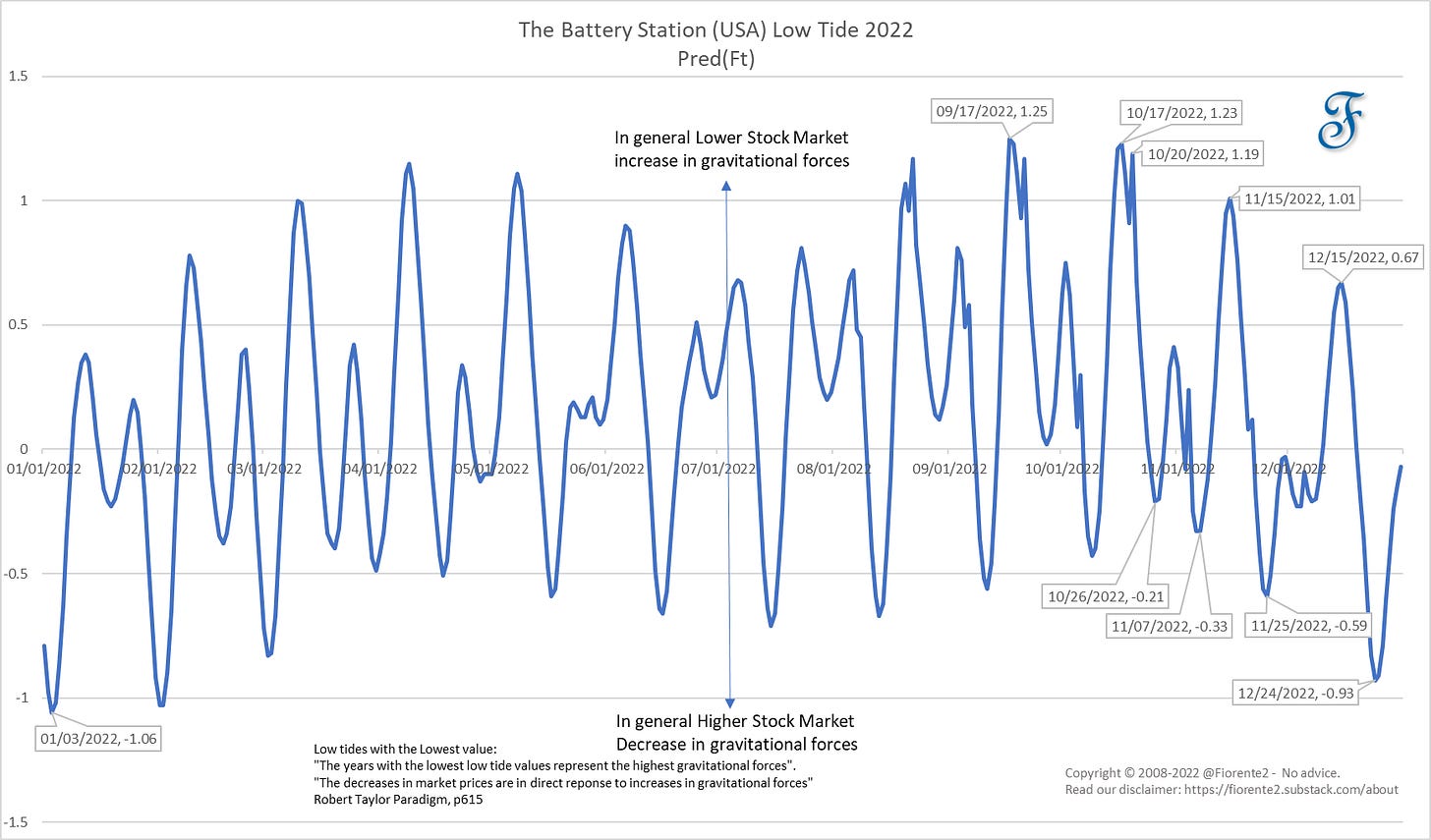

In last week’s post I mentioned that the gravitational forces may have an influence on our behavior on the Stock Market. These forces can e.g. be measured with the heights of the tides. I showed you an example of the Reedy Point Station tide predictions (as this is closest to the majority of the World’s Stock Markets), but the closest station to Wall Street is The Battery Station. The tides closest to Wall Street may have a bigger effect on Wall Street.

In below chart you can find the 2022 tide prediction for the low tides for The Battery Station. At the end of last week, the gravitational forces were less which may have had an inverse relation with the Stock Market performance and explain last week’s market surge.

On the other hand, from the theme of the Gann Master Cycle (threat of nuclear war back in 1962) the current swing upwards cannot be easily explained. The threat has not really gone away. Inflation isn’t going away that fast and interest rates will likely raise again in the very near future. This will certainly show the effects in the economy in the future with a possible recession. Or, are the big boys already starting window dressing their portfolio’s (by trading upwards and slowly releasing the stocks they want to get rid of before the end of the year)? Others may say it was short covering or caused by the FOMO (fear of missing out) effect of investors. Will it be trick-or-treat on Wall Street in the next few weeks?

On the positive side last week’s performance in the US Stock Market Indices compared to the Gann Master Cycle had the same characteristics in terms of the angle the market surged, but the strength was much bigger than 60 years ago. However, it was also a bit earlier than expected. Seen from a Gann Master Cycle perspective perhaps, we are currently trading ahead of time as I will show to the premium subscribers.

The premium subscribers can read further from here and find the latest Gann Master Cycle dynamic updates for the DJIA, the S&P 500 and the 49-year cycle on the Nasdaq Composite. Our premium subscribers can review an updated list of stocks from the S&P100 index which stocks may have a cyclical turn in the next few weeks in this post as well.

Hypothetical or simulated performance based on past cycles have many limitations. Cycles can contract, extend and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Read our disclaimer.