$BTC-USD update Sept 26th 2022

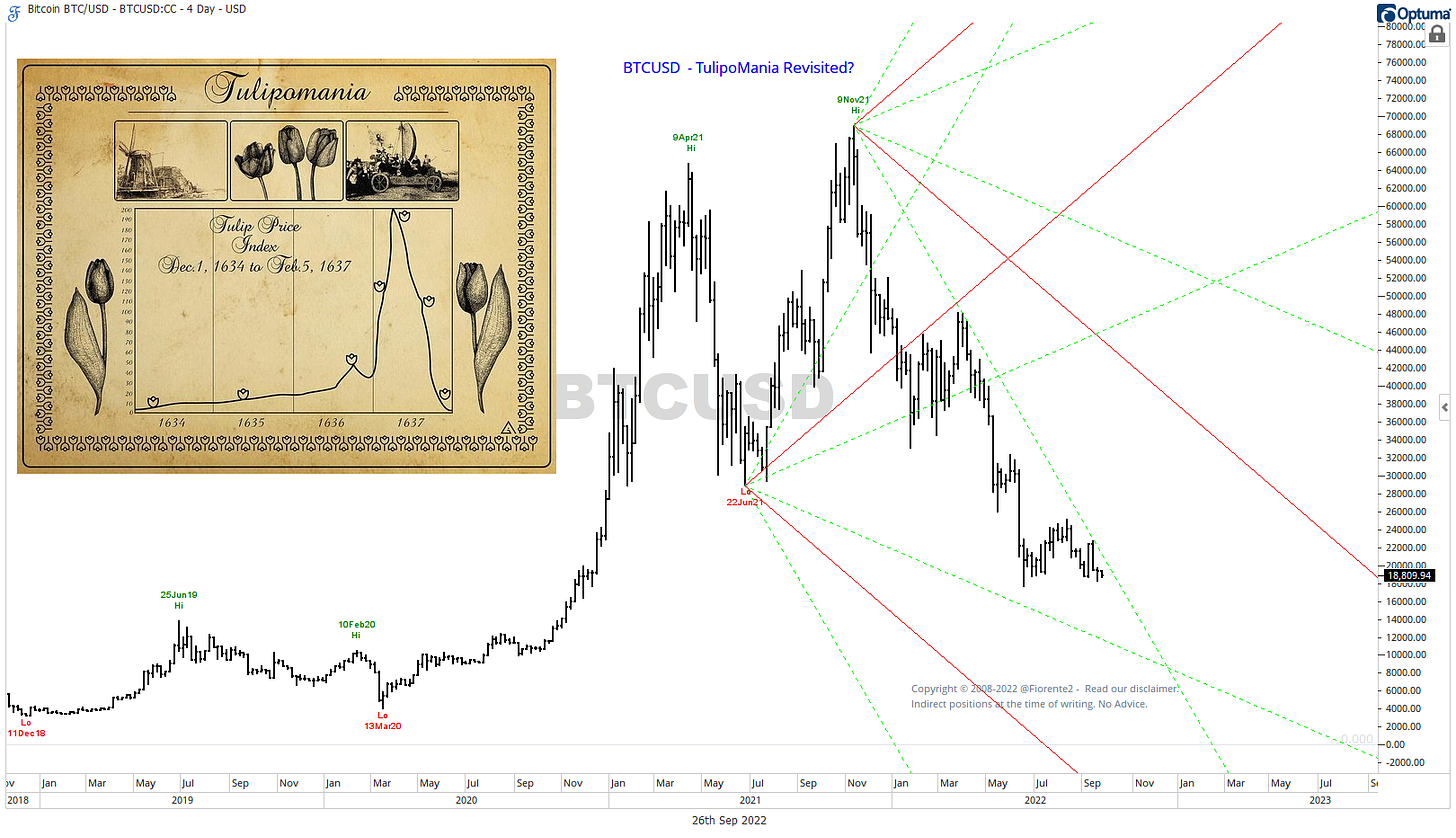

Time is ticking away for $BTC-USD or is $BTC-USD another Tulipomania?

Introduction

During my holidays back in June 19th 2022 I made a quick update on $BTC-USD for a possible square out and change in trend for our premium subscribers. It is time for an update.

On June 19th 2022 I wrote: “Doing a quick price/time analysis on my mobile phone, I found that $BTC-USD may be close to a square out in 225 days at a daily rate of $225 per day. I found that an interesting observation. A low of $18354 has been reached in the past few days, slightly short of 225 days from top. On the Square of Nine a price of 183(00) is opposite 225(days), … “$BTC-USD may have found support here (for now), it may still go lower if time is not up yet and prices do not recover soon above $29500, and …it may be too soon to conclude if $BTC-USD has found support recently or in the next few days at 225 days from All Time High. This seems to be an ideal Gann square out, but cycles can continue if time has not run out yet…”. See our previous post here.

I was right about that timing and until now the rebound seems only to be a consolidation. In my third edition on the Fiorente2 Stock Market Outlook in early May 2022 I already signaled the lack of volume to sustain a further uptrend. I do not think this has changed yet. Currently the high prices in energy does not help crypto- miners in mining new Bitcoins due to the increasing energy needed for mining these.

Perhaps $BTC-USD is now trading towards a 4-year cycle low, but there is limited cycle history to confirm if there is a 4-year cycle in Bitcoin.

Since The People’s Bank of China, the country’s central bank has banned Bitcoin and mining of it and announced it on September 24th 2022, shortly afterwards Bitcoin made its highest high on November 9th 2021. This was 49 days after the September 21st 2021 low which made me think whether the decision was made on that day.

Chinese people once owned the most Bitcoin’s in the world. This may explain the lack of volume experienced since then and if the current trend continues $BTC-USD will vibrate into zero value. Time is ticking away towards that point.

Recently on June 22nd 2022 "The South China Morning Post posted an article “Bitcoin market meltdown prompts fresh warning in China that value of world’s leading cryptocurrency could fall to zero”

This reminded me of the 1637 Tulipomania. You may read more about it here.

The upswing of Tulips back in 1634 started in December and ended on February 5th in 1637. This may be similar to the start of the $BTC-USD upswing in December 2018 and perhaps an ultimate low in February 2023?

The current vibration in Bitcoin seems to be heading towards that same timeframe in spring early next year. Looking into further into it and: considering the Chinese ban on Bitcoin, the day the announcement was made that may have triggered the fall in $BTC-USD, I made below analysis for our premium subscribers. In this analysis I am putting the Pythagorean theory and the law of vibration to work.

Disclosure: Indirect positions in $BTC-USD

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles have many limitations. Cycles can contract, extend and invert. Hence, past performance is no guarantee for the future. No advice. Read our full disclaimer.

Follow us on Twitter, and if you like this post retweet our latest update on Twitter.