A Stock Market Folding Back - Oct 27, 2023

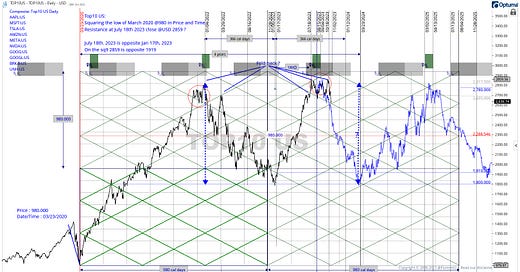

A Gann Master Cycle forecast following the DJIA, SPX, Nasdaq Composite & update on AAPL, MSFT, TSLA, Top10 Composite - #153

Introduction

As mentioned in last week’s article, there was certainly a lack of investors’ confidence, and the main US Indices continued on their slide down. Reviewing the Top 10 US Indices, it seems the end of it is not yet in sight.

The market seems risk-averse at the moment, as shown in the JNK ETF last week. There is a lot of turmoil in the world that does not seem to cease very soon from now.

The recent foldback experienced by the top 10 stocks may not be a good sign for the upcoming months if history repeats itself in a mirrored pattern. After analyzing individual stocks such as AAPL, MSFT, and TSLA, it seems likely that this foldback may continue in the near future.

Astrologically, this may be attributed to the retrograde movement of Neptune and Uranus. This update aims to highlight the astrological symmetry observed at significant pivots that may confirm the mirrored pattern forecast.

It is possible that the market could rebound for a while between the recent Solar eclipse and the upcoming Lunar eclipse on October 28, 2023, as shown in the foldback scenario observed in last week's post. If this happens, it would mean that the 60-year Gann Master Cycle continues on its inverted course. It is more likely with the tensions going on in the World that the upcoming Mars-Uranus panic cycle may intensify the fear which may reflect in the Stock Market.

More on this in this weekly edition of the Fiorente2’s Newsletter. As in this week’s post, I will review Gann Master Cycles for the major US Indices. I will also give a quick update on the foldback in the Top10 composite index that follows the Top10 US Stocks by capital weight.

The charts of AAPL, MSFT and TSLA and the US Indices will underpin the possibilities for a continued downturn. This is a longer-than-usual post, so the email to the premium subscribers may be truncated. However, they can continue to read the full story in the Substack app or on the Substack website.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.