A 90-year Cycle revisited - Mar 10 2023

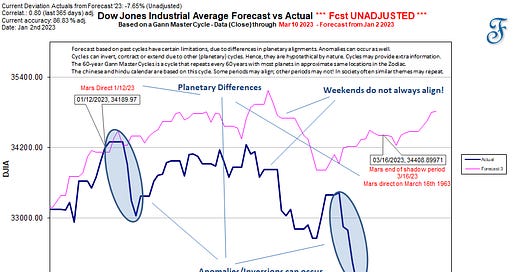

Gann Master Cycle updates for the $DJIA, $SPX and $COMPX

Introduction

Last week it may have shocked many people and institutions to see how a USA bank (the Silicon Valley Bank - SVB Financial Group) failed to meet its obligations to customers and investors on March 9th, 2023. On the 10th of March, trading in this bank was halted.

If W.D. Gann had lived during these times, I am sure he would have noticed the echo of a 90-year cycle. Whenever such a disaster occurs, which affects many people and institutions, I look back, just like him, to what happened on the same day in the past.

So, looking back, I found that when Franklin D. Roosevelt came to power, just a few days after he took the oath of office and became the 32nd President of the USA in 1933, he declared a bank holiday between March 6th and March 10th. Many banks have failed in the USA since the stock market collapsed in 1929-1932. The bank failures even increased in 1933.

He then presented an emergency law that empowered the government to decide which banks were solvent enough to reopen and help those who could not. His speech to the nation was enough for the large public to deposit their money in the “trusted” banks again the following morning. The general bank run was over.1

Later, he signed a law on June 16, 1933, that created the Federal Deposit Insurance Corporation(FDIC). Under this new law, deposits were protected up to $2500, a figure that would rise through the years (to $250000 today), and were subsequently 100% safe.

I am sure W.D. Gann could have agreed that the recent day’s events were an echo of the events in banking 90 years ago. This collapse of the Silicon Valley Bank may still have a ripple effect on the many institutions that have invested in this bank, and they may lose the majority of their money. This may not have the same effect on the general public as has they have often smaller deposits than the $250000 level the FDIC guarantees.

If the 90-year cycle repeats, similar to the past, we may have seen a bottom for now. Next Friday is the triple witching day. The third Friday of the last month of the quarter may give large institutional traders the time to roll over their futures contracts and optimize their portfolios and performance. It may not prevent some further downturn early next week.

For our premium subscribers, I have updated the Gann Master Cycle forecasts for the DJIA, SPX, and COMPX in the below post.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.