Introduction

I regret to inform you that I won't be able to provide an update on the US Indices this weekend. Unfortunately, I caught the Omnikron variant of Coronavirus during the flu season, and I am currently bedridden. A seasonal treat.

I kindly ask for your patience and understanding while I take some time to recover. As soon as I am back in the office, I will extend the subscription of all premium subscribers for the week(s) missed. I expect to be back in office within the next few days. Thank you for your understanding and support.

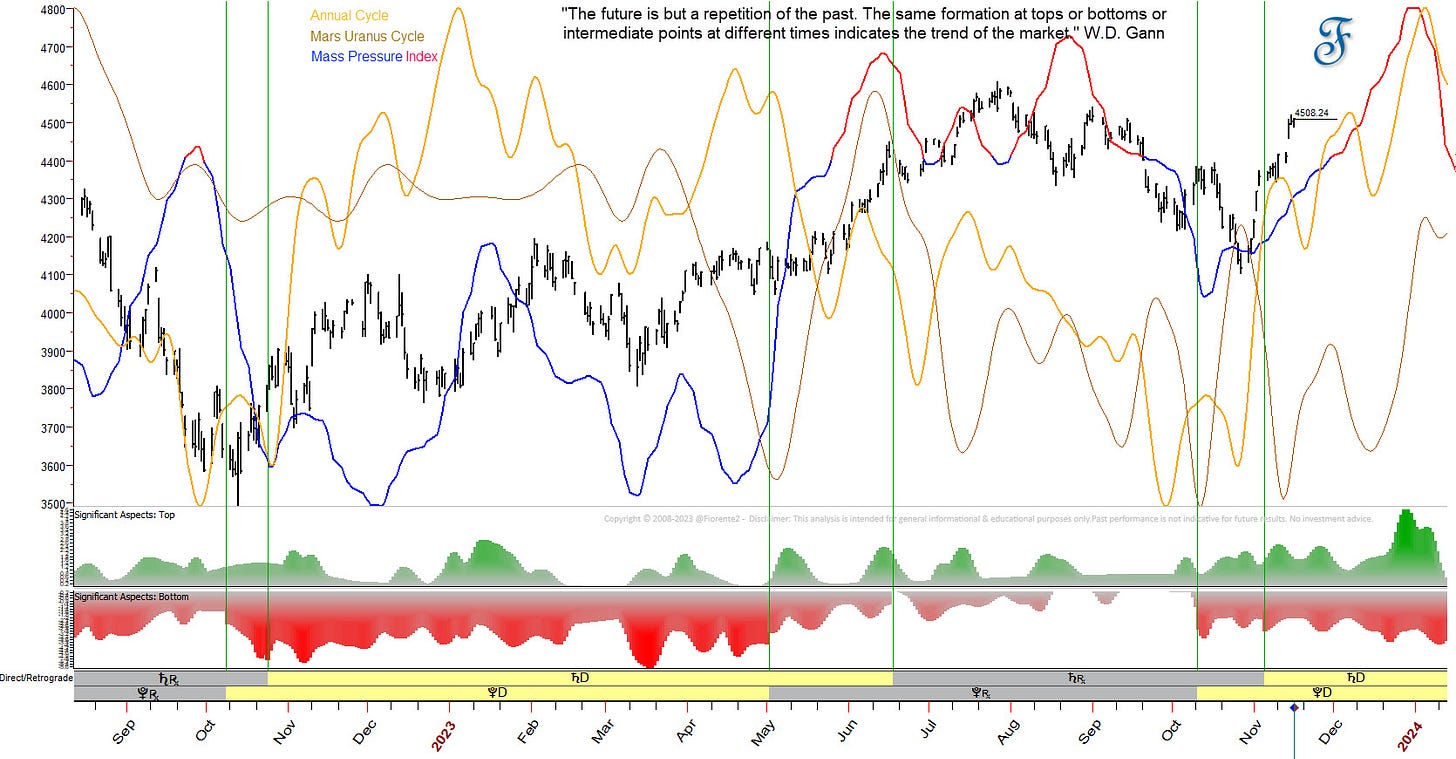

I believe that the current behavior of the US market is in line with my post from two weeks ago titled "Approaching seasonal date". In that post, I displayed the probable direction of the SPX, which has been followed so far.

The Mass Pressure Indicator's direction is determined by all statistically significant cycles that have made at least a 5-10% swing to form a top or a bottom. This has been fully back-tested. But there is never a guarantee that the past will repeat in the same manner.

For premium subscribers from Australia, India, and the Netherlands, I have included the 2023 Mass Pressure Indices for the ASX OA, Nifty50, and AEX in the rest of the post.

Get ready for Fiorente2 Stock Market Outlook 2024, a digital publication that provides a comprehensive analysis of World Indices, Commodities, Gold, Silver, Oil, Wheat, Treasury Notes, and Crypto Currencies. The publication will feature fully back-tested Mass Pressure Index charts for each equity for the full year ahead. Stay tuned for more announcements as soon as possible! Last year’s owners and premium subscribers on Substack will be sent a discount code, as always.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.